United Kingdom 3D Printing Medical Devices Market Size & Outlook, 2025-2033

United Kingdom 3D Printing Medical Devices Market Insights

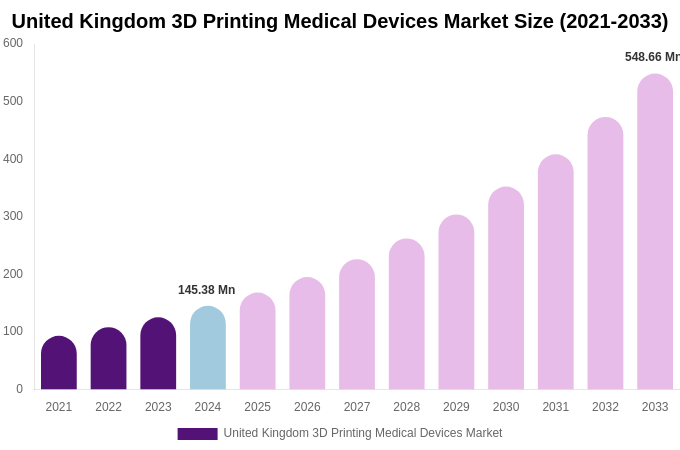

- According to Reed Intelligence analysis, the United Kingdom 3D Printing Medical Devices Market size was USD 145.38 Million in 2024 and is projected to reach USD 548.66 Million by 2033.

- The United Kingdom market is projected to grow at a CAGR of 15.89% between 2025 and 2033.

- By segment, Printers emerged as the largest By Component in terms of market size in 2024.

- Software & Services is anticipated to remain the most attractive By Component segment, recording the fastest growth during the forecast period.

Source: RI Analysis Company Publications, Primary Interviews.

Other Key Findings

- In 2024, United Kingdom represented 4.23% of the overall global 3D Printing Medical Devices Market size.

- United States is projected to lead the global 3D Printing Medical Devices Market size by 2033.

- Across Europe, Germany is anticipated to hold the dominant position in market size by 2033.

- Germany is forecasted to expand at the fastest pace in Europe, attaining USD 731.25 Million by 2033.

Report Summary

| Report Scope | Details |

|---|---|

| Base Year for Study | 2024 |

| Study Period | 2021-2033 |

| Historical Period | 2021-2023 |

| Forecast Period | 2025-2033 |

| Market Size In 2024 | USD 145.38 Million |

| Market Size In 2033 | USD 548.66 Million |

| Largest segment | Printers |

| Units | Revenue in USD Million |

| CAGR | 15.89% (2025-2033) |

| Segmnetation Covered | |

| By Component |

|

| By Technology |

|

| By Application |

|

| By Material |

|

| By End User |

|

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

United Kingdom 3D Printing Medical Devices Market By Component 2025-2033 (USD Million)

| By Component | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Printers | XX.x | XX.x | XX.x | 67.83 | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Materials | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Software & Services | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Hardware | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Total | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

Source: RI Analysis Company Publications, Primary Interviews.

United Kingdom 3D Printing Medical Devices Market By Technology 2025-2033 (USD Million)

| By Technology | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Electron Beam Melting (EBM) | XX.x | XX.x | XX.x | 42.74 | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Laser Beam Melting (LBM) | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Direct Metal Laser Sintering (DMLS) | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Stereolithography (SLA) | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Fused Deposition Modeling (FDM) | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Selective Laser Melting (SLM) | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Selective Laser Sintering (SLS) | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Others (Photopolymerization, Digital Light Processing [DLP], etc.) | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Total | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

Source: RI Analysis Company Publications, Primary Interviews.

United Kingdom 3D Printing Medical Devices Market By Application 2025-2033 (USD Million)

| By Application | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Orthopedic & Cranial Implant | XX.x | XX.x | XX.x | 39.51 | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Dental Restorations | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Surgical Instruments | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Tissue Fabrication | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Custom Prosthetics | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Prosthetics Implant | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Wearable Medical Devices | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Dentistry and Orthodontics | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Others (Tissue-engineered Products, Plastic and Reconstructive Surgeries, etc.) | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Total | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

Source: RI Analysis Company Publications, Primary Interviews.

United Kingdom 3D Printing Medical Devices Market By Material 2025-2033 (USD Million)

| By Material | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Plastics | XX.x | XX.x | XX.x | 65.49 | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Biomaterial Inks | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Metals and Alloys | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Total | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

Source: RI Analysis Company Publications, Primary Interviews.

United Kingdom 3D Printing Medical Devices Market By End User 2025-2033 (USD Million)

| By End User | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Hospitals and Surgical Centers | XX.x | XX.x | XX.x | 61.88 | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Dental and Orthopedic Clinics | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Academic Institutions and Research Laboratories | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Pharma-Biotech and Medical Device Companies | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Clinical Research Organizations | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Total | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

Source: RI Analysis Company Publications, Primary Interviews.

Author :

Reed Intelligence Research Team

The Reed Intelligence Research Team brings together over 15+ years of collective experience in market research, data analytics, and strategic consulting. Comprising seasoned analysts, economists, and industry specialists, the team delivers precise, data-driven insights across sectors including technology, healthcare, energy, manufacturing, and consumer goods. By combining domain expertise with modern analytical tools, they ensure each report meets the highest standards of accuracy and relevance.

In-depth, exclusive market intelligence designed to accelerate your revenue.

Related Reports

Global

North America

United States

Canada

Europe

Germany

United Kingdom

France

Italy

Spain

Russia

Nordic

Benelux

Asia Pacific

China

India

Japan

South Korea

Taiwan

Australia

Singapore

South East Asia

Middle East And Africa

United Arab Emirates

Saudi Arabia

South Africa

Egypt

Nigeria

Turkey

LATAM

Brazil

Mexico

Argentina

Colombia

Chile